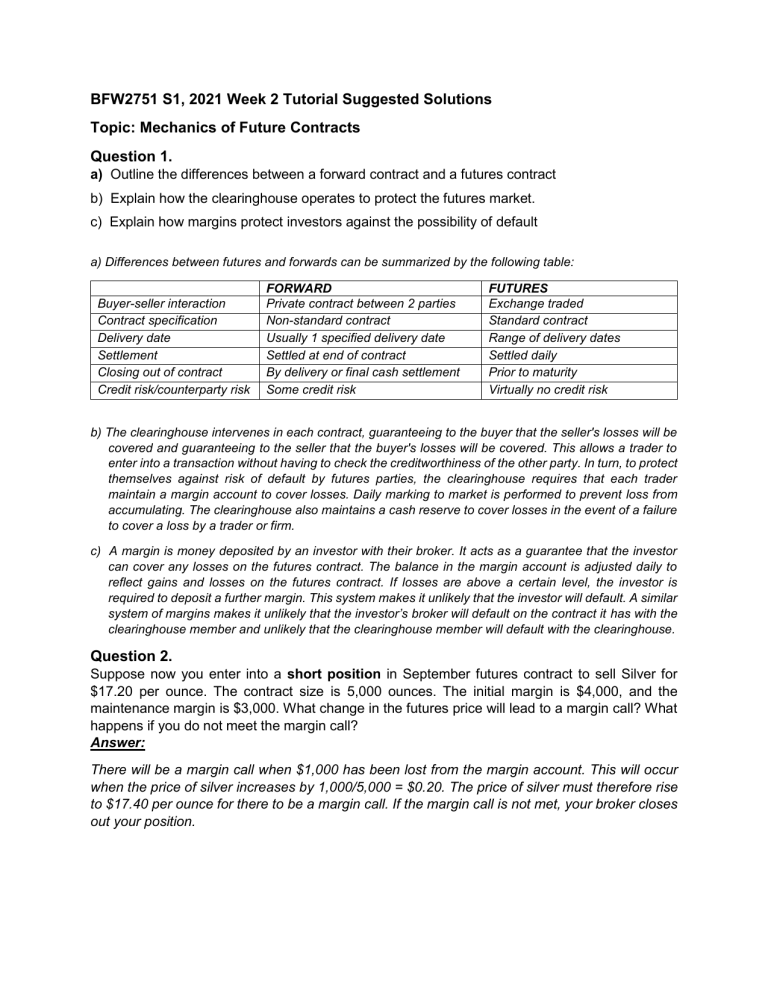

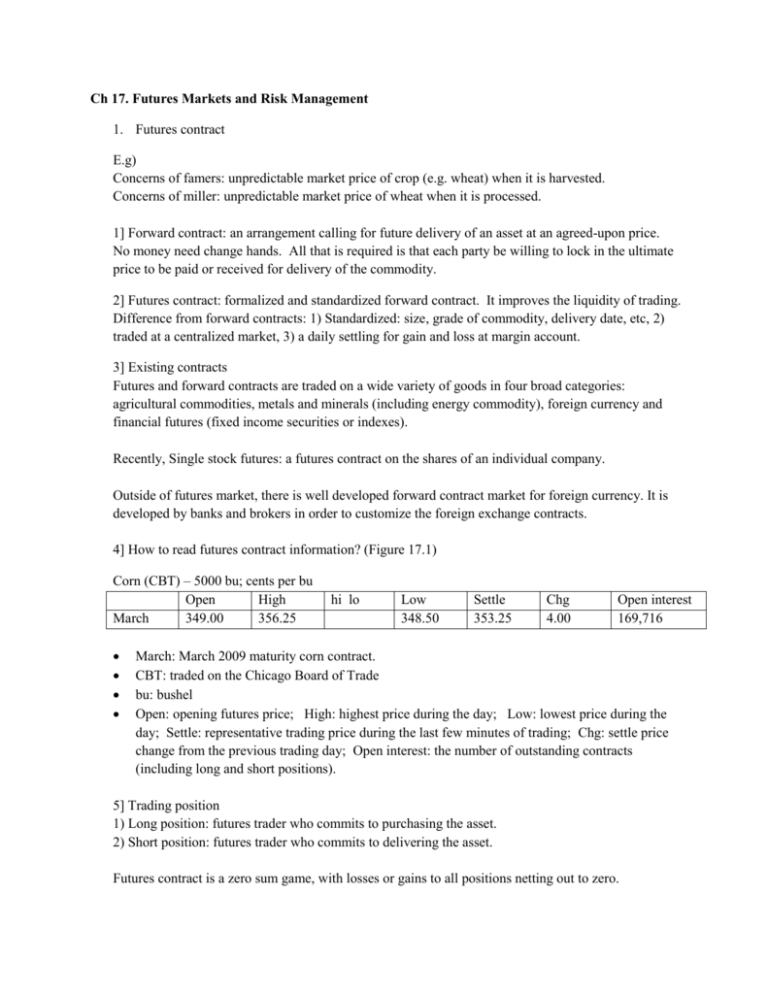

W10 The Futures Market Summary lecture - W10: The Futures Market INTRODUCTION TO FUTURES CONTRACTS - StuDocu

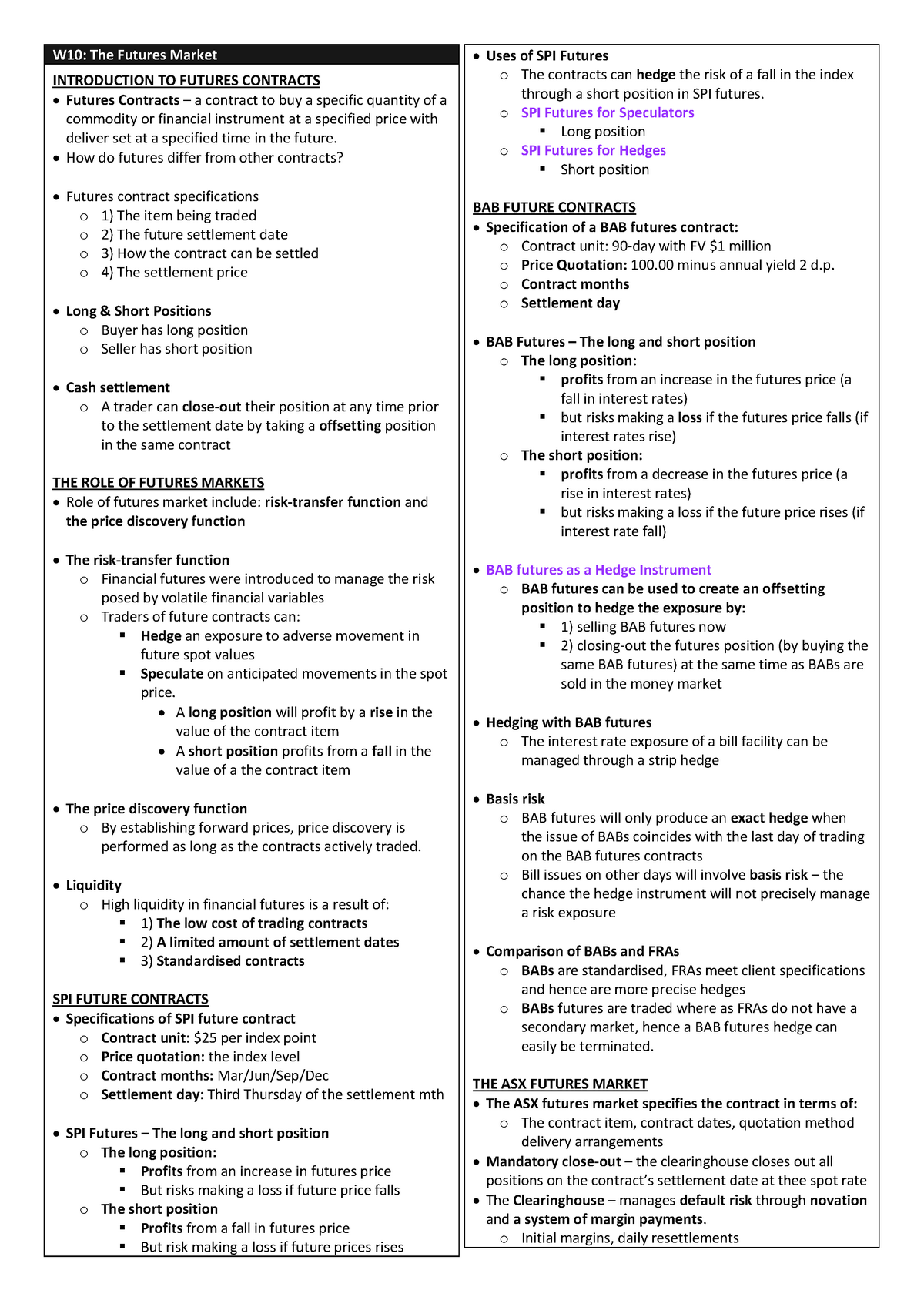

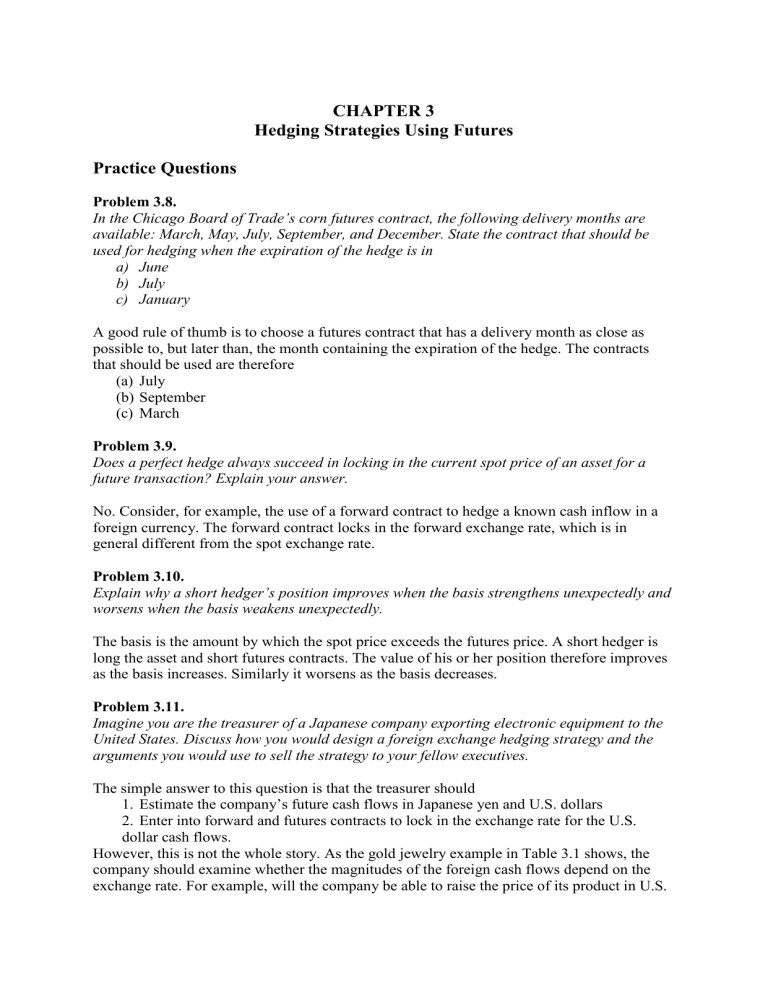

Problems 4 - Tutorial - Problem 3. In the Chicago Board of Trade's corn futures contract, the - StuDocu

Solved] Assume today's settlement price on a CME,EUR futures contract is $1.3140/EUR.You have a short position in one contract.Your performance bond... | Course Hero

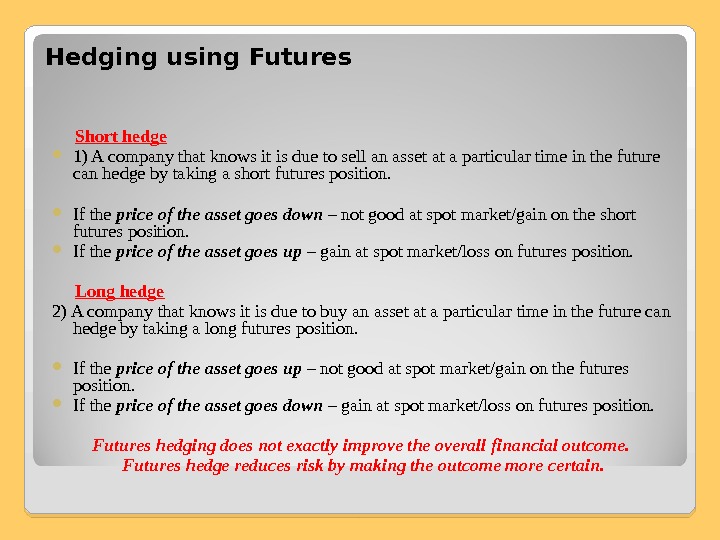

HEDGING LINEAR RISK. HEDGING Risk that has been measured can be managed Hedging: taking positions that lower the risk profile of the portfolio Hedging. - ppt download

:max_bytes(150000):strip_icc()/dotdash_Final_Short_Short_Position_Sep_2020-01-efaa3113009c4bdbb42f0fcc7ad4f653.jpg)

/janus_capital-5bfc2b84c9e77c005143ef7a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Open_Interest_Sep_2020-01-d263b95fe77a43ba8ede1b52131318f5.jpg)